All Categories

Featured

Table of Contents

Note, nevertheless, that this does not say anything about readjusting for inflation. On the plus side, even if you presume your choice would be to buy the stock exchange for those seven years, and that you 'd obtain a 10 percent yearly return (which is much from particular, especially in the coming years), this $8208 a year would be greater than 4 percent of the resulting nominal stock worth.

Instance of a single-premium deferred annuity (with a 25-year deferment), with 4 repayment alternatives. Courtesy Charles Schwab. The month-to-month payment here is highest possible for the "joint-life-only" alternative, at $1258 (164 percent greater than with the immediate annuity). The "joint-life-with-cash-refund" option pays out only $7/month much less, and guarantees at the very least $100,000 will be paid out.

The means you get the annuity will figure out the response to that inquiry. If you get an annuity with pre-tax bucks, your costs decreases your gross income for that year. Ultimate settlements (monthly and/or swelling sum) are tired as normal revenue in the year they're paid. The benefit here is that the annuity may allow you delay tax obligations past the IRS contribution limitations on IRAs and 401(k) plans.

According to , buying an annuity inside a Roth plan results in tax-free repayments. Buying an annuity with after-tax bucks outside of a Roth leads to paying no tax obligation on the portion of each payment credited to the initial premium(s), however the remaining section is taxable. If you're setting up an annuity that begins paying prior to you're 59 years of ages, you may have to pay 10 percent early withdrawal fines to the internal revenue service.

Why is an Retirement Annuities important for long-term income?

The consultant's initial action was to develop a thorough monetary prepare for you, and afterwards clarify (a) exactly how the recommended annuity matches your overall plan, (b) what options s/he thought about, and (c) how such choices would or would certainly not have actually led to lower or greater compensation for the expert, and (d) why the annuity is the exceptional option for you. - Income protection annuities

Certainly, a consultant might try pressing annuities also if they're not the most effective fit for your scenario and objectives. The factor can be as benign as it is the only product they offer, so they drop prey to the proverbial, "If all you have in your tool kit is a hammer, pretty soon whatever begins looking like a nail." While the consultant in this situation may not be unethical, it enhances the risk that an annuity is a bad choice for you.

Tax-deferred Annuities

:max_bytes(150000):strip_icc()/FutureValueofanAnnuity_final-05f2d1d9409646adb05be26c49787a26.png)

Because annuities usually pay the agent marketing them a lot higher payments than what s/he would certainly get for spending your money in common funds - Fixed annuities, not to mention the no compensations s/he 'd obtain if you purchase no-load shared funds, there is a huge reward for representatives to press annuities, and the extra complex the far better ()

An underhanded advisor recommends rolling that quantity right into new "much better" funds that just happen to carry a 4 percent sales lots. Agree to this, and the consultant pockets $20,000 of your $500,000, and the funds aren't most likely to perform better (unless you chose a lot more inadequately to start with). In the exact same instance, the consultant can guide you to acquire a challenging annuity with that $500,000, one that pays him or her an 8 percent payment.

The consultant attempts to rush your choice, claiming the deal will soon disappear. It may undoubtedly, yet there will likely be comparable deals later. The advisor hasn't figured out how annuity repayments will be exhausted. The expert hasn't divulged his/her compensation and/or the fees you'll be charged and/or hasn't revealed you the impact of those on your ultimate payments, and/or the compensation and/or fees are unacceptably high.

Your family members background and present health indicate a lower-than-average life span (Fixed annuities). Current rate of interest, and therefore predicted payments, are traditionally reduced. Also if an annuity is right for you, do your due diligence in contrasting annuities sold by brokers vs. no-load ones offered by the issuing business. The latter might require you to do more of your very own study, or make use of a fee-based monetary advisor that might get payment for sending you to the annuity company, yet may not be paid a higher compensation than for other financial investment choices.

What are the benefits of having an Guaranteed Return Annuities?

The stream of monthly settlements from Social Security is similar to those of a delayed annuity. In reality, a 2017 comparative evaluation made a thorough contrast. The adhering to are a few of the most salient points. Because annuities are voluntary, individuals acquiring them typically self-select as having a longer-than-average life span.

Social Safety benefits are totally indexed to the CPI, while annuities either have no rising cost of living security or at many offer a set portion annual rise that may or might not make up for inflation completely. This type of motorcyclist, as with anything else that increases the insurance firm's risk, requires you to pay more for the annuity, or accept reduced settlements.

How do I apply for an Fixed Indexed Annuities?

Please note: This article is intended for educational functions just, and should not be considered financial guidance. You should get in touch with a monetary professional before making any type of major monetary decisions.

Because annuities are intended for retired life, tax obligations and penalties may apply. Principal Defense of Fixed Annuities. Never ever lose principal as a result of market efficiency as taken care of annuities are not purchased the market. Also throughout market recessions, your money will not be impacted and you will certainly not shed money. Diverse Financial Investment Options.

Immediate annuities. Utilized by those that desire reputable earnings instantly (or within one year of purchase). With it, you can customize income to fit your demands and develop revenue that lasts permanently. Deferred annuities: For those who wish to grow their money over time, but agree to defer accessibility to the cash till retirement years.

How do I receive payments from an Immediate Annuities?

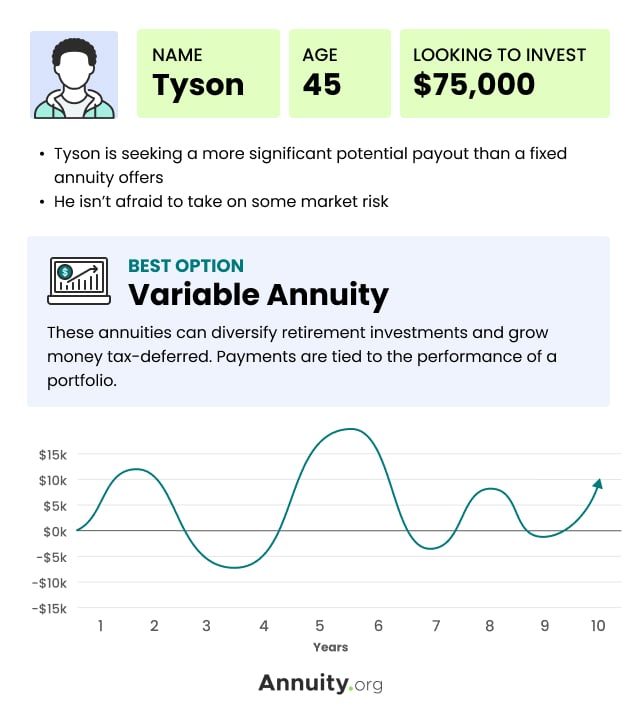

Variable annuities: Provides higher capacity for growth by spending your money in financial investment choices you choose and the capacity to rebalance your portfolio based upon your preferences and in such a way that straightens with transforming financial objectives. With repaired annuities, the business spends the funds and provides a rate of interest price to the customer.

When a fatality insurance claim occurs with an annuity, it is essential to have a called recipient in the agreement. Various choices exist for annuity survivor benefit, relying on the contract and insurance provider. Choosing a reimbursement or "period specific" option in your annuity gives a death advantage if you die early.

What is the most popular Fixed Vs Variable Annuities plan in 2024?

Calling a recipient various other than the estate can assist this process go extra smoothly, and can help make certain that the earnings go to whoever the specific wanted the money to go to rather than going through probate. When present, a fatality benefit is automatically included with your contract.

Table of Contents

Latest Posts

Understanding Deferred Annuity Vs Variable Annuity A Closer Look at How Retirement Planning Works Breaking Down the Basics of Tax Benefits Of Fixed Vs Variable Annuities Features of Smart Investment C

Decoding Indexed Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices What Is Annuities Fixed Vs Variable? Pros and Cons of Various Financial Options Why Fixed Index Annuity Vs Variabl

Breaking Down Fixed Index Annuity Vs Variable Annuities A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Choos

More

Latest Posts