All Categories

Featured

Table of Contents

Annuities are insurance policy products that can eliminate the risk you'll outlast your retired life savings. Today, considering that less individuals are covered by standard pensions, annuities have ended up being significantly popular. They can frequently be integrated with other insurance policy items, like life insurance policy, to produce complete protection for you and your household. It's typical today for those approaching retirement to be concerned concerning their savings and how long they will last.

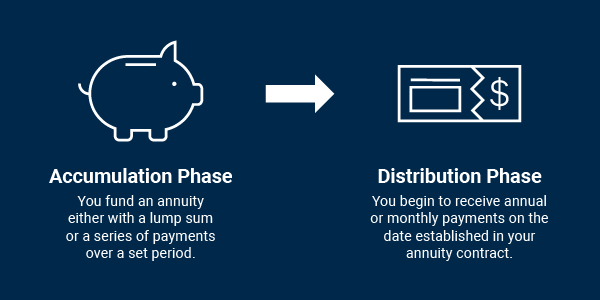

There will certainly always be income for as lengthy as you live. That provides many individuals useful satisfaction. You make a superior payment to an insurer, either in a lump amount or as a series of payments. In return, you'll obtain routine earnings for a given duration, typically for life.

Annuities are no various. Take an appearance at some of the primary advantages of annuities contrasted with other retired life financial savings lorries: Annuities are the only monetary product that can supply you with guaranteed life time earnings and make sure that you are never at risk of outlasting your financial savings.

As holds true with lots of retirement financial savings vehicles, any type of earnings on your deferred annuity are tax-deferred. That suggests you do not pay taxes on the growth in your account till you withdraw it or begin taking payments. In various other words, the tax obligations you 'd normally owe on the gains annually remain in your account and grow, often leaving you with higher balances later on.

What should I look for in an Secure Annuities plan?

1 To discover the most effective item for you, you'll need to search amongst relied on insurance carriers. Among the benefits of annuities is that they are very customizable. The right annuity for you is going to depend upon several factors, including your age, your existing cost savings, for how long you require the earnings, and any kind of protections you might desire.

2 Below are a couple of usual examples: You and your spouse are intending to retire within the following few years. You've both saved a great amount however are currently attempting to crunch the numbers and make sure your financial savings will certainly last. It prevails to worry over exactly how much of your savings to gain access to every year, or for how long your financial savings will certainly require to last.

3 In this way, you and your partner will have earnings you can trust no matter what happens. On the various other hand, allow's state that you remain in your late 20s. You have actually just recently had a good raise at the workplace, and you wish to make certain you're doing whatever you can to ensure a comfortable retired life.

That's an excellent begin. Retirement is a long way off, and that understands exactly how much those cost savings will grow or if there will certainly be enough when you get to retired life age. A variable deferred annuity could be something to add to your retirement. Some annuities allow you to make superior settlements each year.

What types of Fixed Annuities are available?

The annuity will have the possibility to experience development, yet it will additionally be subject to market volatility. New York Life has several alternatives for annuities, and we can aid you tailor them to your family's one-of-a-kind demands. We're here to help. We can stroll you via every one of your alternatives, without stress to acquire.

There are two basic kinds of annuity contracts: prompt and postponed. An immediate annuity is an annuity contract in which repayments start within 12 months of the date of purchase.

Routine payments are deferred till a maturity date stated in the contract or, if earlier, a day selected by the proprietor of the contract - Flexible premium annuities. One of the most usual Immediate Annuity Agreement payment choices include: Insurance provider makes regular payments for the annuitant's life time. An option based upon the annuitant's survival is called a life section alternative

There are two annuitants (called joint annuitants), normally partners and regular payments proceed up until the death of both. The earnings repayment quantity might continue at 100% when only one annuitant lives or be reduced (50%, 66.67%, 75%) throughout the life of the making it through annuitant. Periodic repayments are produced a specific amount of time (e.g., 5, 10 or two decades).

How do I receive payments from an Fixed Indexed Annuities?

Revenue settlements discontinue at the end of the duration. Payments are normally payable in set buck quantities, such as $100 per month, and do not give security versus inflation. Some instant annuities provide inflation defense with routine boosts based upon a set rate (3%) or an index such as the Consumer Price Index (CPI). An annuity with a CPI modification will certainly start with lower repayments or need a greater preliminary premium, yet it will provide a minimum of partial protection from the threat of inflation.

Earnings payments continue to be consistent if the financial investment performance (nevertheless costs) amounts to the assumed investment return (AIR) stated in the agreement. If the financial investment efficiency exceeds the AIR, repayments will enhance. If the investment performance is much less than the AIR, payments will reduce. Immediate annuities usually do not allow partial withdrawals or offer cash surrender advantages.

Such individuals must seek insurance providers that utilize second-rate underwriting and take into consideration the annuitant's wellness condition in identifying annuity revenue repayments. Do you have enough funds to meet your revenue requires without acquiring an annuity? To put it simply, can you take care of and take organized withdrawals from such resources, without worry of outlasting your resources? If you are interested in the risk of outlasting your monetary sources, then you could take into consideration acquiring a prompt annuity at the very least in a quantity enough to cover your fundamental living costs.

What happens if I outlive my Annuity Accumulation Phase?

For some choices, your wellness and marital condition might be considered. A straight life annuity will certainly supply a higher month-to-month income repayment for a provided costs than life contingent annuity with a duration specific or reimbursement attribute. Simply put, the cost of a given revenue repayment (e.g., $100 monthly) will be greater for a life contingent annuity with a period specific or reimbursement function than for a straight life annuity.

A person with a dependent spouse might want to think about a joint and survivor annuity. A person worried with obtaining a minimal return on his or her annuity premium may want to take into consideration a life contingent option with a period specific or a refund function. A variable immediate annuity is frequently selected to equal rising cost of living during your retired life years.

A paid-up deferred annuity, additionally typically described as a deferred revenue annuity (DIA), is an annuity contract in which each costs payment acquisitions a set dollar earnings benefit that begins on a specified date, such as a person's retired life date. The contracts do not preserve an account worth. The costs price for this item is a lot less than for an immediate annuity and it allows a person to preserve control over most of his or her various other possessions throughout retirement, while securing longevity protection.

Table of Contents

Latest Posts

Understanding Deferred Annuity Vs Variable Annuity A Closer Look at How Retirement Planning Works Breaking Down the Basics of Tax Benefits Of Fixed Vs Variable Annuities Features of Smart Investment C

Decoding Indexed Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices What Is Annuities Fixed Vs Variable? Pros and Cons of Various Financial Options Why Fixed Index Annuity Vs Variabl

Breaking Down Fixed Index Annuity Vs Variable Annuities A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Choos

More

Latest Posts